What’s Happening in the Locum Market?

| Share with

PAYE has become the new norm for locums…

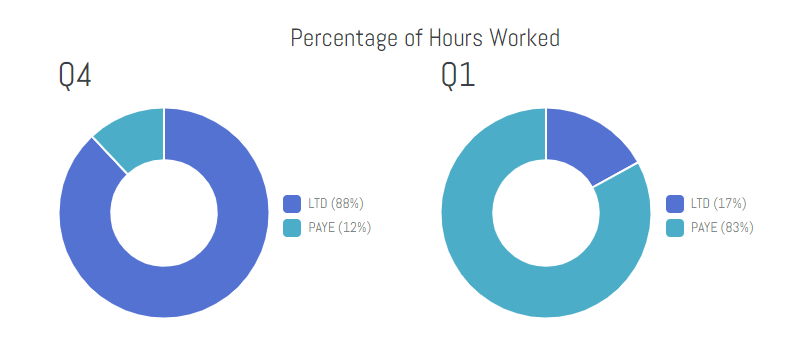

The IR35 legislation has been in force since 1999, but in April this year changes in the rules had a significant impact on the temporary worker market in the NHS. Following the instatement of the new rules, there was an initial backlash from contractors which resulted in the temporary withholding of services. However, this was short-lived and now as the dust settles we are seeing the emergence of trends within contracting. During Q4, 88% of locums working at trusts in our client base were working through limited companies, compared with just 17% in Q1 (Fig. 1).

Agency hours are falling…

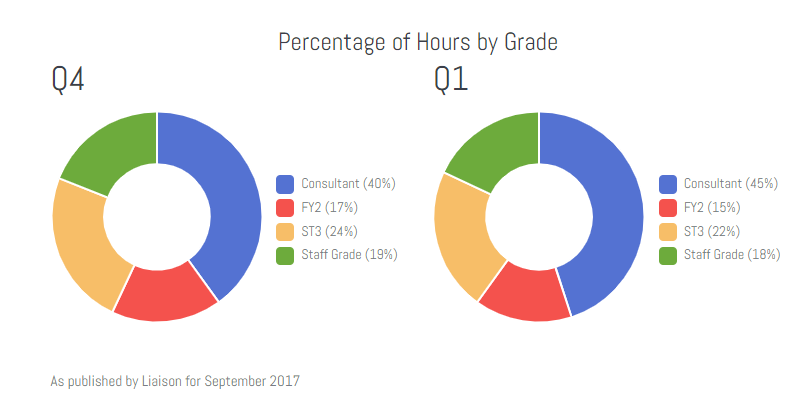

We have also seen the number of agency hours worked in Q1 reduce dramatically whilst the average cost of each hour has increased. This has largely been driven by the increasing proportion of Consultant locum hours, growing by 12% to represent 45% of all locum hours worked. It is more important than ever to convert these hours to bank as the savings per hour converted are greater.

So, where have the hours gone?

As there is no advantage of operating through a PSC, we have seen workers move towards direct engagement PAYE and as a result, they are more likely to work through a trust bank where the availability of shifts is increasing as banks become more established. Trends amongst our client base have demonstrated increases in the proportion of medical bank staff by 12%, with an absolute increase of 20% in the number of hours worked in the last quarter alone.

30 Sep 2017 | Leave a comment

Share with socials